Let me tell you how it will be

There's one for you, nineteen for me

Cos I'm the taxman, yeah, I'm the taxman

Should five per cent appear too small

Be thankful I don't take it all

Cos I'm the taxman, yeah I'm the taxman

If you drive a car, I'll tax the street

If you try to sit, I'll tax your seat

If you get too cold I'll tax the heat

If you take a walk, I'll tax your feet

Taxman!

Cos I'm the taxman, yeah I'm the taxman

Don't ask me what I want it for (Aahh Mr. Wilson)

If you don't want to pay some more (Aahh Mr. Heath)

Cos I'm the taxman, yeah, I'm the taxman

Now my advice for those who die

Declare the pennies on your eyes

Cos I'm the taxman, yeah, I'm the taxman

And you're working for no one but me

Taxman!

There's one for you, nineteen for me

Cos I'm the taxman, yeah, I'm the taxman

Should five per cent appear too small

Be thankful I don't take it all

Cos I'm the taxman, yeah I'm the taxman

If you drive a car, I'll tax the street

If you try to sit, I'll tax your seat

If you get too cold I'll tax the heat

If you take a walk, I'll tax your feet

Taxman!

Cos I'm the taxman, yeah I'm the taxman

Don't ask me what I want it for (Aahh Mr. Wilson)

If you don't want to pay some more (Aahh Mr. Heath)

Cos I'm the taxman, yeah, I'm the taxman

Now my advice for those who die

Declare the pennies on your eyes

Cos I'm the taxman, yeah, I'm the taxman

And you're working for no one but me

Taxman!

---------------------------------------------------------------

So, Here Is Where The $3,000,000,000,000 Comes From

----------------------------------------------------------------

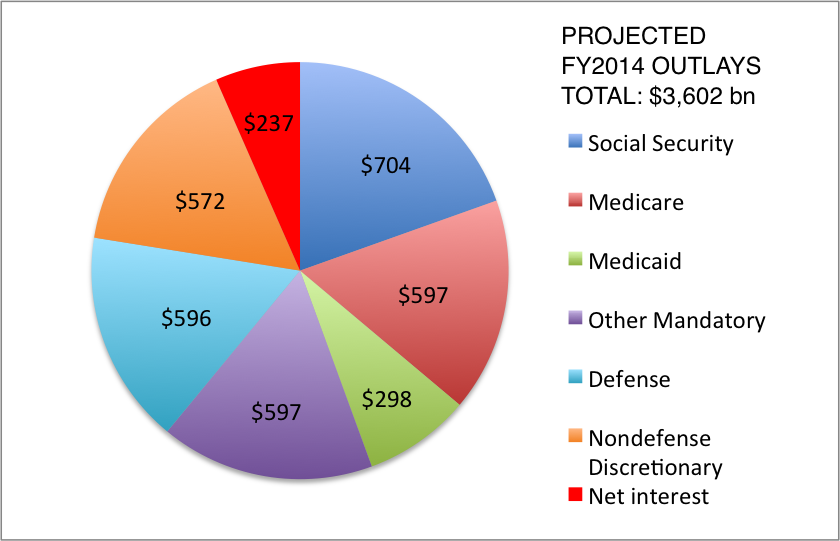

And Here Is Where It Goes

-----------------------------------------------------------------------------------------

But here is an interesting tidbit - the 'discretionary' spending

--------------------------------------------------------------------------------

And of course, minor problem, the outlay is $560,000,000,000 more than the intake

And this is just the Federal Government!

We also get to pay state income taxes, property taxes, state, county and city sales taxes, special assessment taxes, license and use fees, and more. We even get to pay taxes on money that was taken from us as a tax!!

In Colorado, Tax Freedom Day is April 22nd this year, and you can find your state's

So, most of us are still working for the government.

2 comments:

Two comments. We have no income tax, so even though Washington state is 9th, it is a good place for people with high incomes (not that I have one). Second, if you go here and look at the happiness ratings:

http://time.com/9465/here-are-the-50-states-ranked-by-how-happy-their-residents-are/

you find that many of the states with the earliest tax days have the unhappiest populations. Looking at State (tax day rank, happiness rank) you have

Alabama (46,47)

Tennessee (47,44)

S. Dakota (48,2)

Mississippi (49,48)

Louisiana (40, 41)

The glaring exception is South Dakota!!! And its a beautiful state to boot!

I might move to South Dakota, but I'm happy to pay a little bit in taxes to live where I do rather than in any of the other "top ten" tax friendly states.

John - first, color me jealous that you folks have no state income tax. Because I earned some money from Pepperdine during the past couple of years, I have the joy of paying income tax in both states!!! The credit that CO gives does not ease the pain very much.

I understand the unhappiness ratings - probably not too much to do with taxes :-) South Dakota - ya - probably nice a couple of days out of the year. Surprised that Dudley left a no-income-tax state.

See you in Goshen in June.

Post a Comment