With tax day just around the corner for many of us, I found the data regarding who pays what for income taxes to be quite interesting. First, looking at this chart, you will see that the top 1% of income folks pay almost 40% of income taxes, and the top 20% pay nearly 95% of all taxes. Notice that the bottom 40% receive a portion of the taxes rather than paying.

Here is the actual dollar breakdown [with some discrepancies from above chart]:

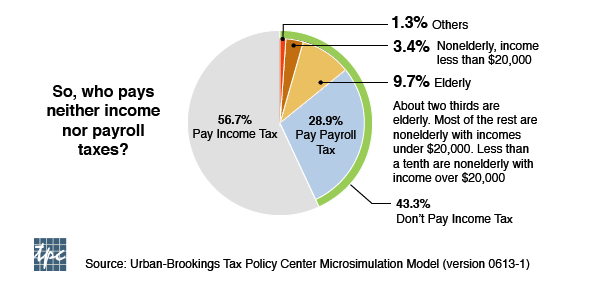

Next is another look at the income tax data. A whopping 45% of households pay no income tax.

And who are these folks who don't pay income tax?

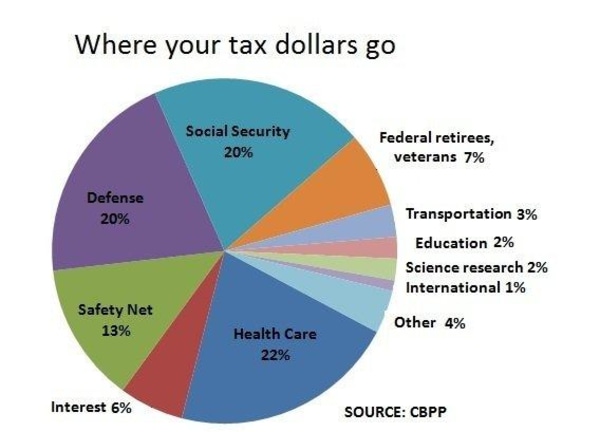

And lastly, where does it all go? [this is pre-Trump who proposes to increase one of the biggest players while decimating some of the smallest players]

6 comments:

VERY informative information! Thanks!

de nada; working on ours today, so am generally in a pissy mood :-)

Filed mine today and got an email that the IRS has accepted my return. Not fun to see that money get sucked out of my checking account, but I think we can agree it is better to be in the group that pays taxes than in the group that doesn't. What I would like is more say on how the money gets spent.

JR - completely agree. Also, when I filed, I got the email that the IRS rejected our return. Checked why, and had entered the wrong SSN for Rhonda - duh. So fixed and sent again, and it was accepted.

Since the 47% or whatever it is that don't pay taxes could care less about government fiscal responsibility and will invariably vote for Santa Claus, I would like to see either everyone taxed and forced to pay something, or voting limited to only those who pay taxes. As I bonus, I would eliminate payroll federal tax withholding and make everyone pay a lump sum of what they owe for the year due the day before election day.

I agree with the ideas that everyone needs to contribute something via taxes; I would like to see the income tax dumped for a national sales tax, with variable rates for different commodities, e.g. low for essentials with escalating rates for 'non essentials'. I like Hong Kong's tax rate for cars - around 100% :-)

Post a Comment