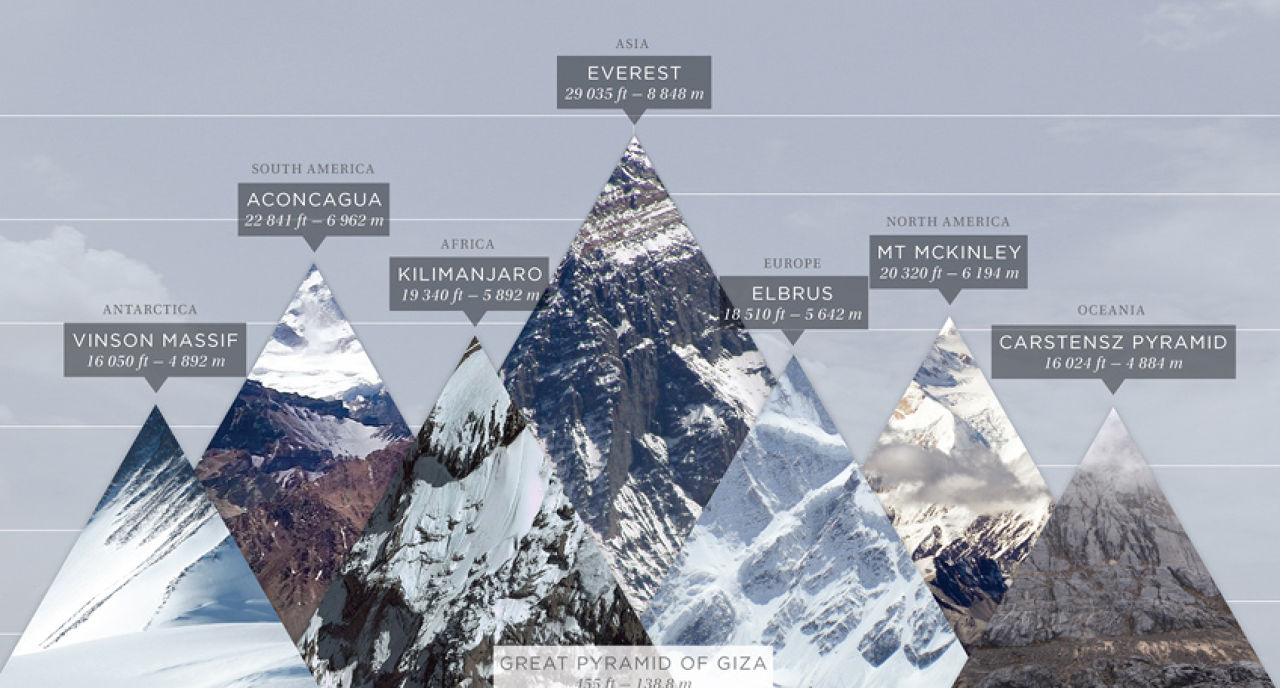

Here is a visual of the highest peaks on each of Earth's continents

Here is a graph of the Down Jones Industrial Average for the past year

Here is a graph of the DJIA over the decades - note interesting Y-axis

Perspectives of a Colorado Curmudgeon on topics ranging from Basketball to Music to Science & Religion to Travel to Memories, touching on a bit of everything.

5 comments:

Interesting information on the heights of mountains comparison. Am thinking the DOW may exceed 20,000, but not stay there. There won't be a crash either. The market is historically high and price/earnings ratios are historically high because interest rates are historically low. When interest rates begin edging up this year, price/earnings ratios and the market will go down somewhat as result.

Thanks Bizzy. I was recently reading how the Dow is not particularly useful for actually gaining any insights to the market and the economy. Too narrow and weighted strangely. Most pros apparently place more emphasis on the NASDAQ.

You are correct, Douglas E. NASDAQ is the one the pros watch. I use the DOW because that is the one ingrained in my brain. I can remember the DOW closed at a little over 8,000 at one point in early 2009, but have no idea what the NASDAQ was at that same time without looking it up. As you say, the DOW can do great while the economy doesn't. It tells me that the 0.01% are making a ton of money while the rest of us aren't.

Biz, you have forgotten all about the S&P 500. It is probably the one the experts watch more than the other two. The S&P 500 includes a larger sample of U.S. stocks and because the S&P 500 is weighted by market-value, it will show, for example, that a 10% change in a $25 stock will affect the index like a 10% change in a $65 stock. The Dow is weighted by price, which means the average is affected much more by the large stocks in its portfolio. The Nasdaq Composite has grown popular because it's commonly accepted as a shorthand indicator of how tech-sector and innovative companies – both big and small – are faring.

Good point Volarius - I agree that the S & P 500 is much better than the DJ.

Post a Comment